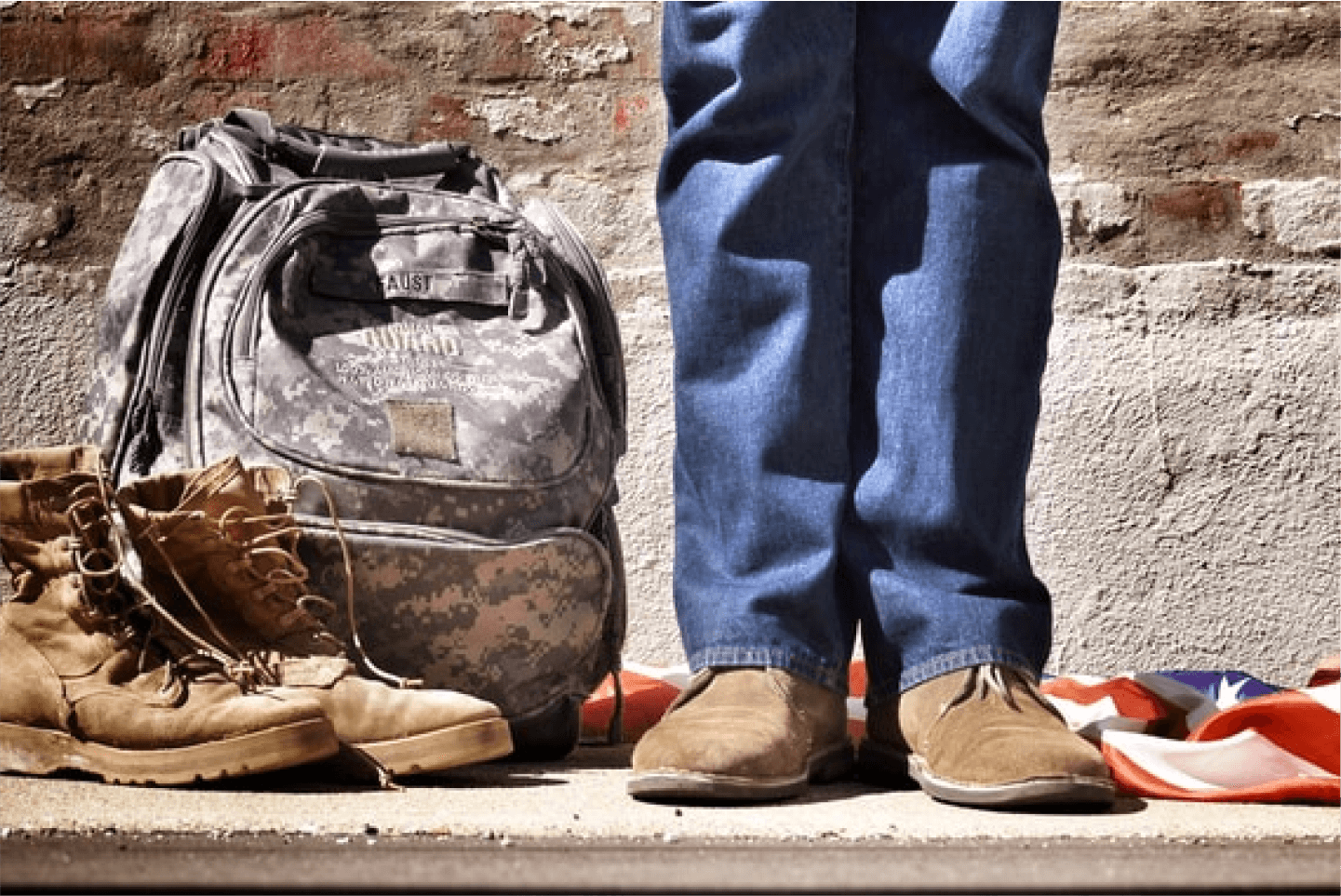

Are you a veteran dreaming of owning your own home? While the path to homeownership can be challenging, there is a solution specifically designed to help veterans like you. VA loans offer an affordable and accessible option to make your dreams come true, allowing you to enjoy the rewards of becoming a homeowner.

One of the key advantages of VA loans is the absence of a down payment requirement, making it easier for you to save money and get one step closer to your dream home. While conventional loans typically require a down payment of at least 20%, VA loans allow eligible veterans to purchase a home with no money down. This can be a significant relief, especially for those who may not have substantial savings to put towards a down payment.

Additionally, VA loans often offer lower interest rates compared to conventional mortgages, resulting in significant long-term savings. The Department of Veterans Affairs guarantees a portion of the loan, which reduces the risk for lenders. This guarantee enables lenders to offer competitive interest rates to veterans, making monthly mortgage payments more affordable. With lower interest rates, you can not only save money monthly, but also over the life of your loan.

Lastly, VA loans provide more flexibility when it comes to credit requirements. While maintaining a good credit score is important, VA loans tend to be more forgiving to veterans with less-than-perfect credit histories. This can be a tremendous benefit for those who have faced financial challenges in the past or who are first-time homebuyers.

In conclusion, if you are a veteran looking for an affordable way to become a homeowner, VA loans are your answer. With the ability to purchase a home with no down payment, low interest rates, and more lenient credit requirements, these loans can provide you with the opportunity to fulfill your homeownership dreams. Take advantage of this fantastic benefit and make your move towards a brighter future with VA loans. #mortgage #veterans